Business travel often goes hand in hand with having a corporate career, however regardless of whether you travel domestically or internationally, there is a fine line between company cost-cutting measures and your ability to perform your role to the best of your ability.

Here are six useful tips that will not only reduce your business travel expenses, but ensure your travel experience is efficient, comfortable and stress-free.

1. Plan and book ahead

Last-minute business travel is sometimes unavoidable, however in terms of reducing travel costs, booking in advance can result in huge savings in terms of your corporate travel budget. Booking accommodation outside of ‘high’ season (during public and school holidays) can assist with cost savings, however so can booking flights early. According to experts, the ideal timeframe to book is around 22 weeks in advance of when you’re looking to travel, and May is the best month to take to the skies. Not surprisingly, peak travel periods like in December and January claim the honour of being the most expensive months to travel in. There are a number of ways you can be alerted to cheaper flights, from apps that will compare flights and offer cost saving alternatives, to airline and travel agent email alerts that will advise you of upcoming travel deals.

2. Check your company’s travel policy

A company’s corporate travel policy should provide specific details about where and when an employee can travel for work, if there are any preferred hotels or airlines an employee should use, and it should offer employees a reasonable travel allowance. Travel allowances are typically payments to an employee that cover business travel expenses when they need to travel for work, and can include things like food, drinks, accommodation, transfers and incidentals. If companies are covered by a modern award or enterprise agreement, then they will usually include some travel related allowances . Of course, the details of these differ according to your job’s requirements, however they can usually be found within workplace policies, or within your own individual employment contract.

3. Use your travel allowance wisely

When it comes to saving money on business travel, you need to smart about how you use your corporate travel allowance. Apart from booking accommodation and flights ahead of time, you can also save money in other ways as well. Try to limit your transportation costs if you can, and weigh up the costs of renting a car over choosing taxis and other transport services. Booking accommodation near to a conference centre or a business meeting venue can also save a lot of time and money, and if within walking distance, allows you to partake in a little exercise while

you’re there as well!

Meals are also one of the factors that can increase business travel expenses, however hotel recommendations are often pricey. Research possible venues before you leave home, consult destination guidebooks and tourism websites, or if travelling domestically, use apps to help you identify the most suitable restaurants in your destination. If you’re staying in a self-contained apartment, stock up the fridge with items from your local supermarket or farmers’ markets, prepare your own gourmet meals and save yourself the time, cost and hassle involved in having to eat out!

4. Be loyal to airlines

If you’re not already a member of an airline frequent flyer program, sign up! These programs are ideal ways of managing corporate travel costs as they offer great incentives to business travellers. Basically, the more loyal you are to an airline, the more upgrades and perks you can receive.

From a domestic standpoint, Qantas offers priority check-ins and additional baggage allowances and Virgin Australia advanced seat selection and valet services. If you’re travelling internationally, you can gain credit points with Singapore Airlines if you book hotel stays with any of their global partners, and Cathay Pacific offers free access to international airport lounges across the globe.

If your employer chooses to issue you a corporate credit card account that’s aligned with a rewards program, you can also gain discounts, rewards points and airline credits for purchases that can save your company money on future flights.

5. Use travel management companies

Using a travel agency or travel management company to organise all of your corporate travel requirements is also worth considering as these businesses can source affordable corporate airfares and accommodation rates, negotiate and book on your behalf, and have an overwhelming positive impact on your company’s business travel expenses.

Many travel management companies also allow employees access to online financial reporting, low-fare search engines and other travel management services that can help employees reduce their business travel costs. These tools will not only help whoever books your travel to gain real-time insights into spending, they can help streamline the booking and approval process. Saving everyone time and money!

6. Claim your expenses!

If you don’t claim your travel expenses via your employer, then it’s worth doing so when you prepare your annual tax return, as it can go a long way towards managing corporate travel costs. The Australian Taxation Office (ATO) has recently updated its guidelines in terms of when an employee can claim travel related tax deductions, and it’s a draft ruling that provides clearer guidance in the context of the modern workplace environment. These guidelines state that an employee can claim tax deductions for travel expenses if they are ‘work related’ and are ‘incurred in earning income’. But what do these terms mean exactly?

Typical tax-deductible travel expenses include accommodation, transport, meals and incidentals that are paid for by an employee during a work related trip, and factor in:

- Whether an employee is required by their employer to travel

- Whether the employee has control and direction over their travel

- Whether the employer is paid in relation to the travel (which excludes a travel allowance)

If you’re still unsure about what you can claim outside of your corporate travel allowance, contact your accountant or the ATO for more information.

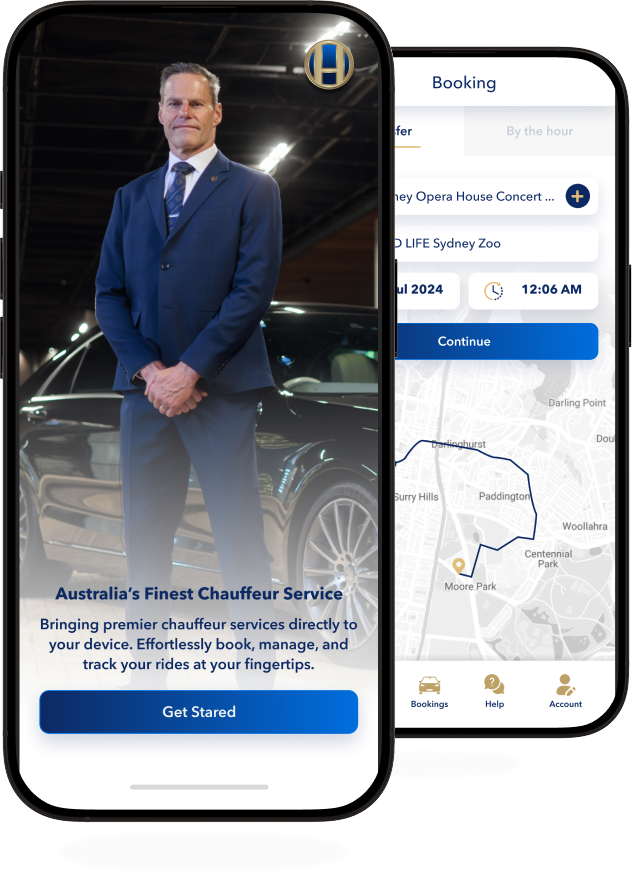

Avoid the long queues and inefficiencies involved in catching a cab. Contact Hughes on 1300 615 165 and hire one of our luxury chauffeured cars today!